It’s no wonder that everyone is talking about the future of Australia’s property market these days. There are good reasons for some concerns too. So if you’re considering selling your home, buying a new one, or investing in real estate within the next 12 months. You’ll want to keep this possible trendline decline in both house prices and interest rates in mind. Yes, when we look out over the horizon with this information available today–the predictions may seem unavoidable. It’s predicted that both house price declines and bank interest rates will experience sharp peaks sometime soon–mainly because they are already starting to rise! This reality combined with an ever-increasing cost of living means we’ll need to say goodbye at least temporarily to what feels like our own golden age right now.

Which Direction The Real Estate Market

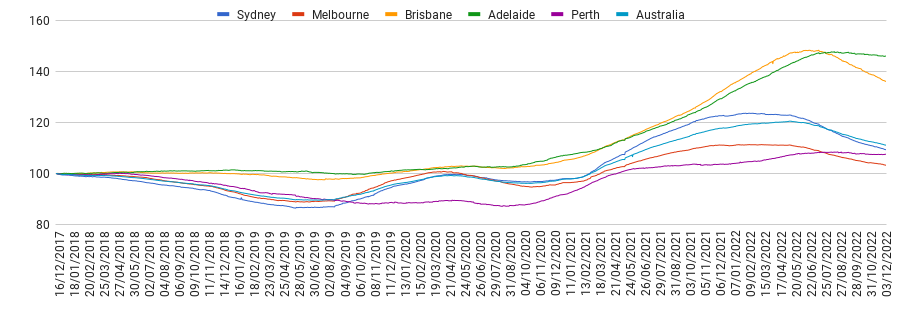

In June 2022, Australian property prices began to roll over after an incredible boom led by Sydney, which fell for the first time in two years – 2.7%.

Credit Goes To CoreLogic index, rebased to 100 5 years ago, updated daily, 29th November 2022

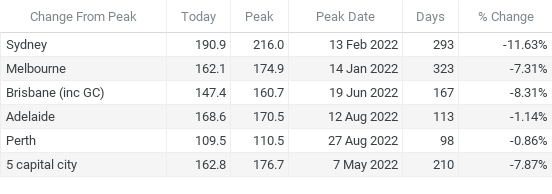

Across the board, prices have dropped in every city, but not all cities have seen the same levels of decrease. The day difference since the recent peak and the percent of change have been highlighted in the table below.

Credit Goes To CoreLogic Index, updated daily, 29th November 2022

Thanks to interest rate predictions by the four major banks. The slight sense of apprehension we talked about earlier is starting to creep in.

In the last quarter of 2019, national house prices grew by 4% and the real interest rate hovered around 1.5%.

However, don’t give up yet…

Expert opinions

What’s the predicted Property Market in your State by the year 2023?

According to ANZ, Australia’s property Market prices will fall across the country significantly in 2022 and 2023, followed by a small rebound in 2024.

Source: RateCity.com.au. ANZ property price forecasts, CoreLogic index-adjusted median values, 31 December 2021 and 31 July 2022.

In short, it’s not all bad news.

Predictions indicate that, come 2023, rates will have stabilized and in 2024 all capital cities will see a boost in housing prices.

That year, rising wages and easing mortgage rates are expected to boost housing prices by 5%.

In other words, rate hikes, an increase in the number of people interested in securing the best deals to compete, and investors coming back in droves might affect the market more than a cyclical effect.

Despite the increase in rates, the demand for housing finance is still healthy among upgraders, movers, and downsizers.

This substantial decline in property price estimates should be seen as an adjustment following very substantial increases in the last few years.

Is it the right time to sell?

If you need property appraisals or would like to learn more about the market from your top local agents, you’ve come to the right place.

Get in touch with our local expert team at +61 413 388 102 or check out our agents now.